Latest Blogs

CCFS-2026: MCA OPENS ONE-TIME COMPLIANCE WINDOW FOR COMPANIES TO COMPLETE PENDING FILING WITH REDUCED FEES

Companies Compliance Facilitation Scheme, 2026 (CCFS-2026): A Complete Breakdown for Businesses On 24th…

Read More

GSTN Introduces Online Withdrawal Facility Under Rule 14A via Form GST REG-32 (2026 Update)

The Goods and Services Tax Network (GSTN) has rolled out a structured online mechanism enabling eligible…

Read More

Decoding Section 247: Search & Seizure Under India’s New Income-Tax Act 2025 Explained

Decoding Search & Seizure in India’s New Income-Tax Law: A Complete Guide for Taxpayers With…

Read More

New Income Tax Act 2025: Will It Really Help You Save More?

New Income Tax Act 2025: Will It Really Help You Save More? India is set to witness one of the biggest…

Read More

ITC under GST Explained: Section 16, Blocked Credit, Supplier Default & Legal Issues

Input Tax Credit under GST: Law, Limitations, Litigation & the Real Business Impact When GST was…

Read More

RBI Directs Agency Banks to Remain Open on March 31, 2026 for FY 2025–26 Closure

Reserve Bank of India Ensures Seamless Year-End Government Accounting for FY 2025–26 As Financial…

Read More

ITAT Deletes ₹4.67 Crore Addition Under Section 68: Major Relief for Cooperative Credit Societies

ITAT Deletes ₹4.67 Crore Addition Under Section 68: Major Relief for Cooperative Credit Societies In…

Read More

Income Tax Refunds Finally Credited After Long Delay – What Taxpayers Must Know in 2026

Income Tax Refunds Finally Credited After Long Delay – What Taxpayers Must Know After weeks of…

Read More

Corporate Mitras in Union Budget 2026: Empowering MSMEs or Redefining Professional Boundaries

Introduction The Union Budget 2026–27 introduced a noteworthy proposal that has ignited significant…

Read More

Section 74 GST Order Set Aside for Ignoring Taxpayer Reply: High Court Ruling

Introduction India’s GST litigation framework continues to evolve through judicial interpretations…

Read More

CIT vs Reliance Petroproducts Pvt. Ltd. (2010): A Detailed Analysis of Wrong Tax Claims vs Concealment of Income

Introduction Penalty provisions under taxation laws are essential tools used by governments to ensure…

Read More

Difference Between TDS and TCS in India – Meaning, Examples, Rates & Budget 2026 Updates

Difference Between TDS and TCS – Complete Guide with Updated Insights When you step into a high-end…

Read More

Draft Income Tax Rules 2026: How ITR-1 to ITR-7 Will Change From April 2026

Govt Releases Draft Income Tax Rules 2026: How ITR-1 to ITR-7 May Change for Taxpayers India’s…

Read More

AIS & Form 26AS Mismatch – How It Triggers Income Tax Notices & How to Avoid It

AIS & Form 26AS Mismatch – How It Can Trigger Income Tax Notice Introduction In recent years,…

Read More

Penalty for Late Filing of Income Tax Return (ITR) – Section 234F, Due Dates & Budget 2026 Updates

Penalty for Late Filing of Income Tax Return Taxpayers are required to file their Income Tax Return…

Read More

Income Tax Slabs for FY 2025-26 (AY 2026-27): New vs Old Regime Rates

Income Tax Slabs for FY 2025-26 (AY 2026-27): New vs Old Regime Rates Income Tax Slabs Remain the Same…

Read More

ITAT Ahmedabad Deletes Deemed Rent on Vacant Flats | Section 23 Explained

ITAT Ahmedabad Ruling on Deemed Rent: A Landmark Relief for Property Owners Introduction In a significant…

Read More

Taxpayer Cannot Escape GST Liability by Blaming CA — Explained with High Court Ruling, Legal Context & Practical Takeaways

Taxpayer Cannot Escape GST Liability by Blaming CA — Explained with High Court Ruling, Legal Context…

Read More

Union Budget 2026: Date, Expectations, Income Tax, GST and Financial Impact Explained in Detail

Union Budget 2026 Explained: Date, Income Tax, GST & Financial Impact The Union Budget 2026–27…

Read More

Budget 2026: Should Married Couples Be Allowed to File Joint Tax Returns?

Understanding the ICAI Proposal for Husband-Wife Tax Filing Reform As India prepares for the Union Budget…

Read More

₹374 Crore GST Identity Theft Scam: How Fake Firms, Stolen PANs and Paper Transactions Triggered a Major EOW Probe

₹374 Crore GST Identity Theft Scam: How Fake Firms, Stolen PANs and Paper Transactions Triggered a Major…

Read More

One GST Notice for Multiple Years? Why Separate Notices Are Mandatory When Issues Differ

Legal Validity, Risks and Strategic Response This article deals with a very practical and litigation-oriented…

Read More

Form 10B Delay Won’t Deny Section 11 Exemption: ITAT Delhi

Form 10B Delay Won’t Deny Section 11 Exemption: ITAT Delhi Reaffirms Taxpayer-Friendly Approach…

Read More

Budget 2026: Why Income Tax Amendments Will Apply Under 2025 Act

Why Budget 2026 Will Amend the New Income-tax Act, 2025 (Not the Old 1961 Law) A Detailed Explanation…

Read More

₹8 Lakh GST Notice to Bengaluru Driver: Identity Theft & Fake GST Firms

₹8 Lakh GST Notice to a Bengaluru Driver: A Wake-Up Call for Every Taxpayer Identity Theft, Fake Firms…

Read More

ITR Filing Last Date for FY 2025–26 (AY 2026–27)

ITR Filing Last Date for FY 2025–26 (AY 2026–27) For individual taxpayers who are not liable…

Read More

Presumptive Taxation Under Section 44AD & 44ADA Explained

Section 44AD – Presumptive Taxation Scheme for Businesses The presumptive taxation scheme enables…

Read More

New IT Act, 2025 to Replace 60-Year-Old Tax Law from April 1

New Income Tax Act, 2025: A Landmark Shift in India’s Direct Tax System India is on the brink…

Read More

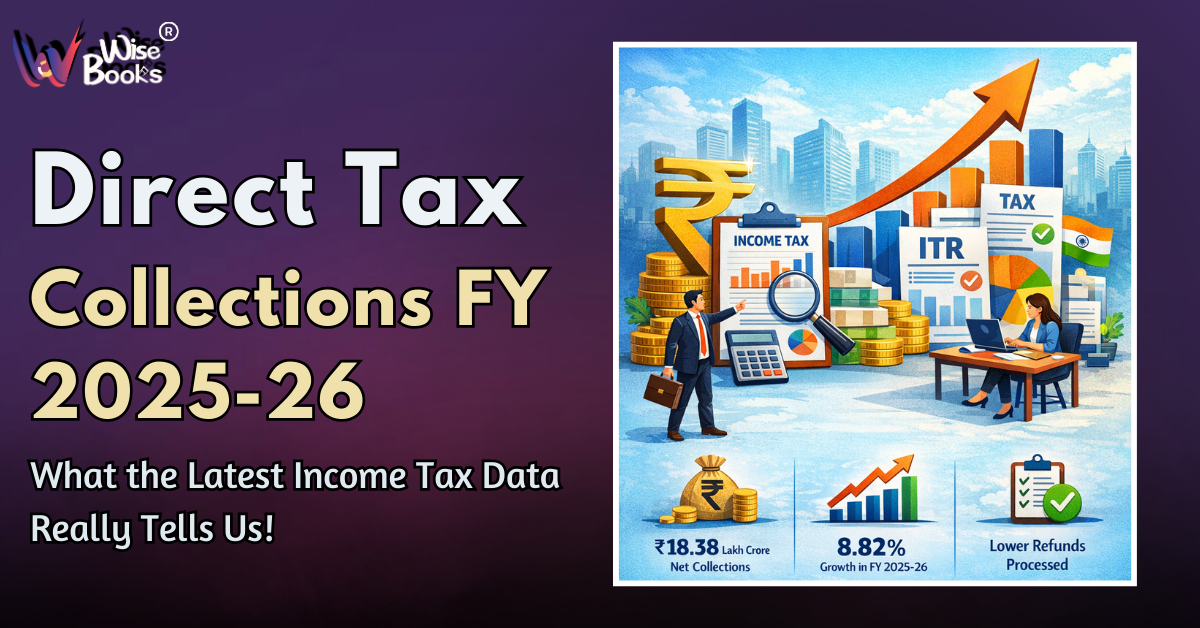

Direct Tax Collections FY 2025-26: What the Latest Income Tax Data Really Tells Us

Direct Tax Collections FY 2025-26: What the Latest Income Tax Data Really Tells Us The Income Tax Department…

Read More

Union Budget 2026 Expectations: Impact on Businesses, GST, Income Tax & MSMEs

Union Budget 2026: Expectations, Policy Direction & What It Means for Businesses As Finance Minister Nirmala…

Read More

GSTN Hard Validations: ITC, RCM & GSTR-3B Compliance Guide

GSTN Introduces Hard Validations: ITC, RCM & GSTR-3B Compliance GuideIntroduction The Goods and…

Read More

TDS on Reimbursements: When Is TDS Not Applicable? Complete Legal & Practical Guide

Are You Deducting TDS on Pure Reimbursements? You Might Not Need To — Here’s the Complete…

Read More

Crypto Taxation in India: An Overview (2026)

Crypto Taxation in India: An Overview (2026) As of January 2026, India has put in place one of the most…

Read More

Why Finance Minister Nirmala Sitharaman’s Ninth Consecutive Budget Matters

Why Finance Minister Nirmala Sitharaman’s Ninth Consecutive Budget Matters A Detailed Analysis…

Read More

Important GST Changes and Amendments Made in 2025 Which Will Impact Your Taxation in 2026

Introduction The year 2025 marked a decisive and transformative phase in India’s Goods and Services…

Read More

New Year, New Compliance: How Businesses Must Prepare for GST, Income Tax & Regulatory Scrutiny

Introduction The beginning of a new financial year or calendar year marks a decisive phase for businesses…

Read More

Govt Notifies February 1 as End of GST Compensation Cess & Launch of New Tobacco Tax Regime (2026)

Introduction: A Defining Shift in India’s Indirect Tax Architecture On January 1, 2026, the Ministry…

Read More

FMCG Sector Rebounds as GST 2.0 Dust Settles: Inventory Normalisation Signals Sales Upswing

Introduction: FMCG Enters a Recovery Phase After GST 2.0 Transition India’s Fast-Moving Consumer…

Read More

MCA Filing Deadline Extended to January 2026

Why It Was Extended and How It Benefits Businesses & Taxpayers The Ministry of Corporate Affairs…

Read More

Compliance vs Evasion: Where Finance Ends & Law Begins

Introduction In the modern regulatory environment, businesses operate at the intersection of finance…

Read More

Ahead of Budget 2026-27: MSMEs Demand Policy Action on Credit, Exchange Risks & Tariff Shocks

As India approaches the presentation of the Union Budget 2026-27, pre-budget consultations have…

Read More

BJP Professional Cell Requests Finance Minister to Extend GSTR-9 and 9C Filing Deadline

The BJP Professional Cell has formally approached the Union Finance Minister, Smt. Nirmala Sitharaman…

Read More

Income Tax Department Flags Refund Claims Under Risk Review for AY 2025–26

Refund Hold vs Notice: Understanding the Difference Clearly Many taxpayers panic when they receive an…

Read More

Sources of Law in India

Sources of Law in India Introduction Law plays a fundamental role in shaping society by regulating human…

Read More

GSTR-9 & GSTR-9C – DETAILED AUDIT & VERIFICATION GUIDE

1. Pre-Audit Planning & Scope Definition Applicability of GSTR-9C The audit process begins with…

Read More

Union Budget may ease GST compliance burden for micro and small enterprises: Report

The Union Government is believed to be considering major steps regarding minimizing the Goods and Services…

Read More

Major GST Audit Gaps Exposed: CAG Warns of Manpower Shortage in CBIC Audit Wings

On Thursday, the Comptroller and Auditor General of India (CAG) released a significant audit report…

Read More

Beware of Fake Income Tax Refund Messages: A Growing Threat to Taxpayers in India

The Income Tax Department has issued a strong public advisory after observing a significant surge in…

Read More

GST Annual Return Deadline Extension: Why Professionals Are Demanding More Time

The Goods and Services Tax (GST) annual return filing has always been one of the most demanding compliance…

Read More

Income Tax Refund Delay Explained: 6 Key Reasons Why Your Refund Is Still Pending

Income Tax Refund Delay Explained: 6 Key Reasons Why Your Refund Is Still Pending Waiting for an income…

Read More

Section 119(2) Relief for Leave Encashment

Leave encashment is a common retirement benefit given to employees. Although Exemption under the Income…

Read More

Goods and Services Tax (GST) Explained: How India’s Indirect Tax System Works What Is GST in India?

GST stands for Goods and Services Tax. It is an indirect tax that has replaced multiple indirect taxes…

Read More

A Person Cannot “Shortcut” GST Appeal Process Through Writ Petition — Orissa HC Reiterates Mandatory Pre-Deposit Requirement (Section 112(8))

A recent ruling issued by the Orissa High Court reiterated that taxpayers are not permitted to circumvent…

Read More

GSTR-9 Turnover Limits and Requirements

GSTR-9 Turnover Limits and Requirements GSTR-9 is the annual return under the GST law, intended to give…

Read More

Why Is CBDT Sending SMSs and Emails to Wealthy Taxpayers?

Over the past few weeks, several high-income earners, investors, and entrepreneurs have been receiving…

Read More

GSTN Enables Auto-Suspension of GST Registration for Missing Bank Details Under Rule 10A

A Complete, Updated & Detailed Guide for Taxpayers, CAs, Consultants, and Businesses The Goods and…

Read More

Budget 2026: Will the Old Tax Regime Be Scrapped as 80% Taxpayers Shift to the New Regime? A Detailed Analysis

As the Union Budget 2026 draws near, there is one question in the air that has taken priority over all…

Read More

Advance Tax Rules for FY 2025–26: Who Must Pay, Due Dates, Calculations & Key Exemptions

Advance tax, also called the “pay-as-you-earn” scheme, asks the taxpayer to pay income tax…

Read More

GST rate rationalisation has largely fixed the inverted duty structure, says Sitharaman

Finance Minister Nirmala Sitharaman said on Tuesday that the recent rationalisation of the Goods and…

Read More

Revised and Belated Income Tax Return Filing: Deadlines, Eligibility & Step-by-Step Guide

Mistakes while filing your ITR are quite common; the positive part is that these are easily correctable.…

Read More

MCA Updates Definition of Small Company: Paid-up Capital Limit Raised to ₹10 Crore & Turnover to ₹100 Crore (December 2025)

MCA Update (GSR 880(E), Dated 1 December 2025) The Ministry of Corporate Affairs (MCA) has issued a…

Read More

December 2025 Tax Compliance Deadlines for Income Tax and GST

The Tax Compliance Tracker for December 2025 highlights all essential statutory deadlines under the…

Read More

CBDT Confident of Meeting FY26 Direct Tax Target; Refund Checks Slow Outflows — What Taxpayers & MSMEs Must Know

The Central Board of Direct Taxes is confident of achieving the ambitious ₹25.2 trillion direct tax…

Read More

What is e-Invoicing Under GST? Applicability, Limit, Rules & Implementation Date

e-Invoicing under GST is a system wherein invoices are validated electronically through a government-approved…

Read More

GST registration to be suspended if you do not give bank account details at the earliest; These taxpayers get exemption from this

GSTN issued a very important advisory on November 20, 2025, stating that changes regarding Rule 10A…

Read More

PENALTIES AND LATE FEES FOR NOT FILING GST NIL RETURN ON TIME

Even when there is no sale or purchase in a month for your business, it would still be required…

Read More

GST Rule Change: GSTN to time-bar returns pending over 3 years-what it means, why it matters & what businesses must do

A critical GST compliance reform is going to change the way businesses handle their past tax filing…

Read More

Govt to notify new ITR forms, Income Tax Act 2025 rules by January 2026: CBDT chief

The Income Tax Department is gearing up for a major compliance shift as it prepares to notify brand-new…

Read More

ITR Filing FY 2024–25: Refunds Delayed for Months—How Much Interest You May Be Owed Checks Slow Payout ?

Many taxpayers who filed their ITRs for FY 2024–25 weeks or even months ago are still waiting…

Read More

Section 80C of the Income Tax Act – Complete 80C Deduction List

Section 80C of the Income Tax Act – Complete 80C Deduction List Section 80C allows taxpayers to…

Read More

Gujarat High Court Rules: No Interest Under Section 50 After Tax Deposit in Electronic Cash Ledger — A Major Relief for GST Taxpayers

A Major Relief for GST Taxpayers If a taxpayer deposits GST early in the electronic cash ledger but…

Read More

Section 73 vs Section 74: High Court Sends GST Assessment Back for Fresh Examination

Understanding why invoking the proper GST provision is so vital for taxpayers. A…

Read More

GST Updates & Amendments in 2025: Key Changes to Know

Goods and Services Tax 2.0: Implemented on September 22, 2025, GST 2.0 constitutes one of the biggest…

Read More

HSN Code: Definition, Full Form, List and Structure User

HSN refers to the Harmonized System of Nomenclature, which is a uniform structure for the classification…

Read More

GST Appellate Tribunal to Open in States by December – A New Era for Tax Dispute Resolution in India

WEST BENGAL LEADS THE WAY GSTAT TO START BY DECEMBER 2025 The indirect tax landscape of India is all…

Read More

Madras HC Reaffirms Safeguards for Taxpayers Under Rule 86A on ITC Blocking

Rule 86A and the Protection of Taxpayers’ Rights in ITC Blocking The present article examines…

Read More

Now get faster tax refunds and easier ITR corrections: New CBDT rules explained

Now Get Faster Tax Refunds and Easier ITR Corrections: New CBDT Rules Explained The Central Board of…

Read More

Your November 2025 GST Compliance Guide: Deadlines, New Rules, Best Practices.

Your November 2025 GST Compliance Guide. GST Compliance Guide: Deadlines, New Rules, Best Practices.…

Read More

CGST Delhi South Commissionerate Busts ₹31.95 Crore Fake ITC Racket – Lessons for Businesses & Compliance

The CGST Delhi South Commissionerate busted a fake ITC racket of about ₹31.95 crore. The investigation…

Read More

Approval of GST Registrations within 3 Days from 01 Nov 2025: CBIC Notifies New Rules.

Approval of GST Registrations within 3 Days from 01 Nov 2025: CBIC Notifies New Rules. Getting your…

Read More

What is accounting? Why does a business need accounting?

What is accounting? Why does a business need accounting? Understanding Accounting in Business: Role,…

Read More

What is GST Appellate Tribunal (GSTAT): Rules, Composition, Members, Powers & Duties, Appeal Fees

What is GST Appellate Tribunal (GSTAT)? The GST Appellate Tribunal (GSTAT) is a quasi-judicial body…

Read More

CBIC Now Sanctions 90% Provisional Refunds for Inverted Duty Structure Claims

One of the biggest liquidity challenges for manufacturers in India has been the inverted duty structure…

Read More

GSTAT Launched in 2025: Which GST Orders Can Be Referred to the New Appellate Tribunal?

The long-awaited Goods and Services Tax Appellate Tribunal (GSTAT) has been formally notified in 2025.…

Read More

TDS/TCS Compliance: Consequences of Non-Compliance and Prevention Tips

Consequences of Non-Compliance in TDS/TCS and How to Prevent Them Tax Deducted at Source (TDS) and Tax…

Read More