Income Tax Blogs

Decoding Section 247: Search & Seizure Under India’s New Income-Tax Act 2025 Explained

Feb 23, 2026

Decoding Search & Seizure in India’s New Income-Tax Law: A Complete Guide for Taxpayers With the new Income-tax…

Read More →

New Income Tax Act 2025: Will It Really Help You Save More?

Feb 21, 2026

New Income Tax Act 2025: Will It Really Help You Save More? India is set to witness one of the biggest tax law reforms in…

Read More →

ITAT Deletes ₹4.67 Crore Addition Under Section 68: Major Relief for Cooperative Credit Societies

Feb 17, 2026

ITAT Deletes ₹4.67 Crore Addition Under Section 68: Major Relief for Cooperative Credit Societies In a significant relief…

Read More →

Income Tax Refunds Finally Credited After Long Delay – What Taxpayers Must Know in 2026

Feb 16, 2026

Income Tax Refunds Finally Credited After Long Delay – What Taxpayers Must Know After weeks of anxiety and uncertainty…

Read More →

CIT vs Reliance Petroproducts Pvt. Ltd. (2010): A Detailed Analysis of Wrong Tax Claims vs Concealment of Income

Feb 12, 2026

Introduction Penalty provisions under taxation laws are essential tools used by governments to ensure compliance, transparency,…

Read More →

Difference Between TDS and TCS in India – Meaning, Examples, Rates & Budget 2026 Updates

Feb 11, 2026

Difference Between TDS and TCS – Complete Guide with Updated Insights When you step into a high-end showroom to purchase…

Read More →

Draft Income Tax Rules 2026: How ITR-1 to ITR-7 Will Change From April 2026

Feb 09, 2026

Govt Releases Draft Income Tax Rules 2026: How ITR-1 to ITR-7 May Change for Taxpayers India’s taxation framework…

Read More →

AIS & Form 26AS Mismatch – How It Triggers Income Tax Notices & How to Avoid It

Feb 05, 2026

AIS & Form 26AS Mismatch – How It Can Trigger Income Tax Notice Introduction In recent years, the Income Tax Department…

Read More →

Penalty for Late Filing of Income Tax Return (ITR) – Section 234F, Due Dates & Budget 2026 Updates

Feb 04, 2026

Penalty for Late Filing of Income Tax Return Taxpayers are required to file their Income Tax Return (ITR) to report the…

Read More →

Income Tax Slabs for FY 2025-26 (AY 2026-27): New vs Old Regime Rates

Feb 03, 2026

Income Tax Slabs for FY 2025-26 (AY 2026-27): New vs Old Regime Rates Income Tax Slabs Remain the Same In the Budget 2026,…

Read More →

ITAT Ahmedabad Deletes Deemed Rent on Vacant Flats | Section 23 Explained

Jan 30, 2026

ITAT Ahmedabad Ruling on Deemed Rent: A Landmark Relief for Property Owners Introduction In a significant and taxpayer‑friendly…

Read More →

Taxpayer Cannot Escape GST Liability by Blaming CA — Explained with High Court Ruling, Legal Context & Practical Takeaways

Jan 29, 2026

Taxpayer Cannot Escape GST Liability by Blaming CA — Explained with High Court Ruling, Legal Context & Practical…

Read More →

Budget 2026: Should Married Couples Be Allowed to File Joint Tax Returns?

Jan 24, 2026

Understanding the ICAI Proposal for Husband-Wife Tax Filing Reform As India prepares for the Union Budget 2026, one of the…

Read More →

Form 10B Delay Won’t Deny Section 11 Exemption: ITAT Delhi

Jan 20, 2026

Form 10B Delay Won’t Deny Section 11 Exemption: ITAT Delhi Reaffirms Taxpayer-Friendly Approach The Income Tax Appellate…

Read More →

ITR Filing Last Date for FY 2025–26 (AY 2026–27)

Jan 16, 2026

ITR Filing Last Date for FY 2025–26 (AY 2026–27) For individual taxpayers who are not liable to tax audit, the…

Read More →

Presumptive Taxation Under Section 44AD & 44ADA Explained

Jan 15, 2026

Section 44AD – Presumptive Taxation Scheme for Businesses The presumptive taxation scheme enables eligible taxpayers…

Read More →

New IT Act, 2025 to Replace 60-Year-Old Tax Law from April 1

Jan 14, 2026

New Income Tax Act, 2025: A Landmark Shift in India’s Direct Tax System India is on the brink of a significant transformation…

Read More →

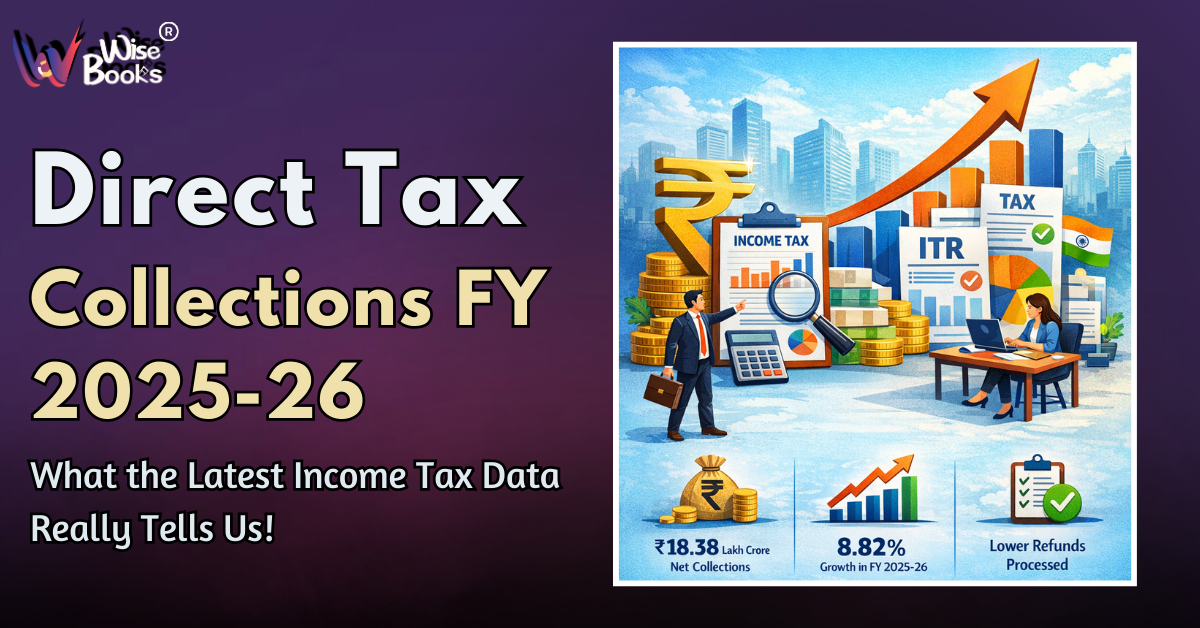

Direct Tax Collections FY 2025-26: What the Latest Income Tax Data Really Tells Us

Jan 13, 2026

Direct Tax Collections FY 2025-26: What the Latest Income Tax Data Really Tells Us The Income Tax Department of India has…

Read More →

Crypto Taxation in India: An Overview (2026)

Jan 08, 2026

Crypto Taxation in India: An Overview (2026) As of January 2026, India has put in place one of the most structured and clearly…

Read More →

Beware of Fake Income Tax Refund Messages: A Growing Threat to Taxpayers in India

Dec 18, 2025

The Income Tax Department has issued a strong public advisory after observing a significant surge in fraudulent income tax…

Read More →

Income Tax Refund Delay Explained: 6 Key Reasons Why Your Refund Is Still Pending

Dec 16, 2025

Income Tax Refund Delay Explained: 6 Key Reasons Why Your Refund Is Still Pending Waiting for an income tax refund can be…

Read More →

Section 119(2) Relief for Leave Encashment

Dec 15, 2025

Leave encashment is a common retirement benefit given to employees. Although Exemption under the Income tax Act is available…

Read More →

Why Is CBDT Sending SMSs and Emails to Wealthy Taxpayers?

Dec 10, 2025

Over the past few weeks, several high-income earners, investors, and entrepreneurs have been receiving unsolicited SMSs…

Read More →

Budget 2026: Will the Old Tax Regime Be Scrapped as 80% Taxpayers Shift to the New Regime? A Detailed Analysis

Dec 08, 2025

As the Union Budget 2026 draws near, there is one question in the air that has taken priority over all discussions within…

Read More →

Advance Tax Rules for FY 2025–26: Who Must Pay, Due Dates, Calculations & Key Exemptions

Dec 06, 2025

Advance tax, also called the “pay-as-you-earn” scheme, asks the taxpayer to pay income tax in installments during…

Read More →

Revised and Belated Income Tax Return Filing: Deadlines, Eligibility & Step-by-Step Guide

Dec 04, 2025

Mistakes while filing your ITR are quite common; the positive part is that these are easily correctable. Section 139(5)…

Read More →

CBDT Confident of Meeting FY26 Direct Tax Target; Refund Checks Slow Outflows — What Taxpayers & MSMEs Must Know

Nov 26, 2025

The Central Board of Direct Taxes is confident of achieving the ambitious ₹25.2 trillion direct tax collection target for…

Read More →

Govt to notify new ITR forms, Income Tax Act 2025 rules by January 2026: CBDT chief

Nov 20, 2025

The Income Tax Department is gearing up for a major compliance shift as it prepares to notify brand-new Income Tax…

Read More →

ITR Filing FY 2024–25: Refunds Delayed for Months—How Much Interest You May Be Owed Checks Slow Payout ?

Nov 19, 2025

Many taxpayers who filed their ITRs for FY 2024–25 weeks or even months ago are still waiting for their refunds, even…

Read More →

Section 80C of the Income Tax Act – Complete 80C Deduction List

Nov 18, 2025

Section 80C of the Income Tax Act – Complete 80C Deduction List Section 80C allows taxpayers to claim deductions of…

Read More →

CGST Delhi South Commissionerate Busts ₹31.95 Crore Fake ITC Racket – Lessons for Businesses & Compliance

Nov 06, 2025

The CGST Delhi South Commissionerate busted a fake ITC racket of about ₹31.95 crore. The investigation revealed that…

Read More →

Approval of GST Registrations within 3 Days from 01 Nov 2025: CBIC Notifies New Rules.

Nov 04, 2025

Approval of GST Registrations within 3 Days from 01 Nov 2025: CBIC Notifies New Rules. Getting your GST registration approved…

Read More →

TDS/TCS Compliance: Consequences of Non-Compliance and Prevention Tips

Jul 06, 2025

Consequences of Non-Compliance in TDS/TCS and How to Prevent Them Tax Deducted at Source (TDS) and Tax Collected…

Read More →