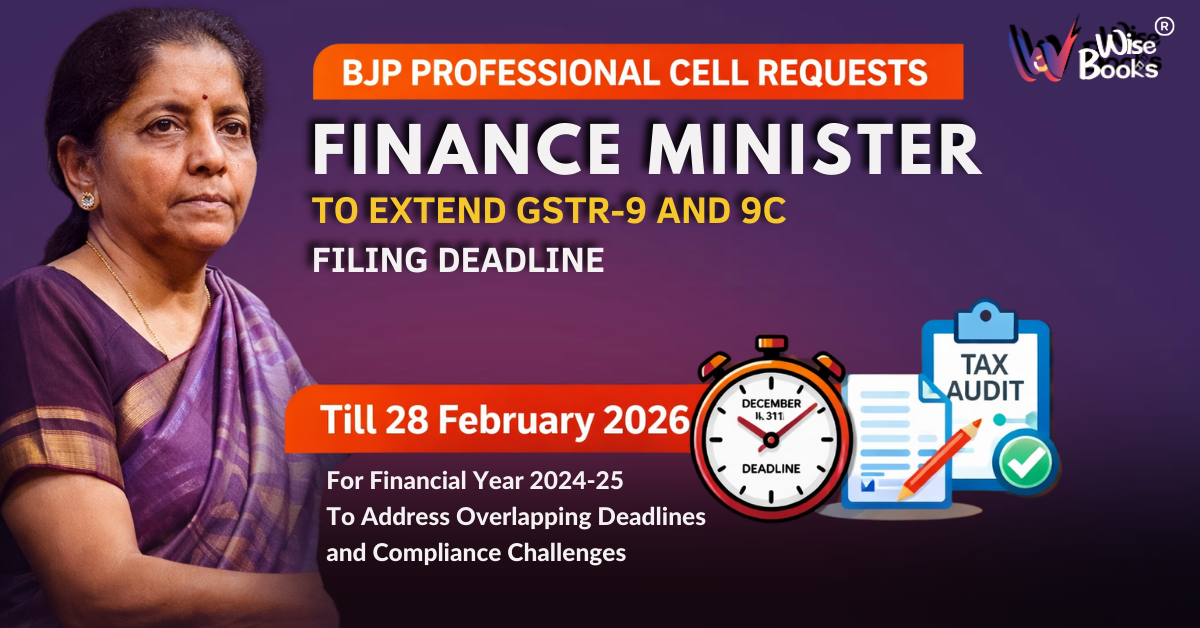

The BJP Professional Cell has formally approached the Union Finance Minister, Smt. Nirmala Sitharaman is requesting an extension of the due date for filing GSTR-9 (Annual Return) and GSTR-9C (Reconciliation Statement) under the Goods and Services Tax (GST) law for the Financial Year 2024–25.

Currently, the due date for filing both these critical GST compliance forms stands at 31 December 2025. However, professionals across the country have raised serious concerns regarding practical difficulties, time constraints, and frequent system changes, which may impact the accuracy and quality of filings if no extension is granted.

Who Made the Representation and Why It Matters

The representation was submitted by CA Shailesh R. Ghedia, President of the BJP Professional Cell. The Professional Cell represents the concerns of Chartered Accountants, tax practitioners, and compliance professionals, who are directly responsible for ensuring correct GST filings for businesses.

This request carries significance because it reflects ground-level compliance challenges faced by professionals and taxpayers alike, rather than being a mere demand for relaxation. The focus of the request is not delay, but on ensuring accurate, error-free, and compliant GST annual returns.

Understanding the Importance of GSTR-9 and GSTR-9C

GSTR-9 – GST Annual Return

GSTR-9 is a comprehensive annual return that consolidates all GST transactions for the financial year. It includes details of:

- Outward and inward supplies

- Input Tax Credit (ITC) availed and reversed

- Taxes paid

- Amendments made during the year

This return must perfectly reconcile with monthly or quarterly filings such as GSTR-1 and GSTR-3B, making it a complex and time-consuming exercise.

GSTR-9C – Reconciliation Statement

GSTR-9C is a certified reconciliation statement, comparing:

- Turnover as per audited financial statements

- Figures reported in GST returns

- ITC as per books vs GST records

Any mismatch reported in GSTR-9C may invite departmental scrutiny, notices, or future audits, making precision absolutely critical

Overlapping Income Tax Audit Deadline Creates Heavy Burden

One of the most significant issues raised in the representation is the extension of the Income Tax Audit deadline to 10 December 2025, which directly clashes with the preparation period for GST annual returns. Income tax audits are extensive in nature and require detailed examination of financial records, verification of transactions, preparation of audit reports, and resolution of multiple client-level queries. Since these audits conclude close to mid-December, professionals are already under immense pressure before even beginning the GST annual return process.

The finalization of books of accounts itself becomes a challenge during this period. For GST annual compliance, books must be fully closed, reconciled, and audited. Many businesses finalize their accounts only after the completion of income tax audits, leaving professionals with limited time to ensure that the financial data is accurate and consistent with GST records. Any delay or adjustment at this stage directly affects the preparation of GSTR-9 and GSTR-9C.

GST reconciliations further add to the workload. These reconciliations involve matching outward supplies, inward supplies, and tax payments reported in GST returns with the figures appearing in the books of accounts. In addition, input tax credit must be reconciled with auto-populated data from GSTR-2A and 2B. This process is highly data-intensive and requires careful verification to identify mismatches, ineligible credits, and reversals. Completing such detailed reconciliations within a short span of time significantly increases the risk of errors.

The annual return filing process under GSTR-9 is not merely a formality but a comprehensive consolidation of all GST transactions for the year. It requires consistency across multiple returns filed during the year and alignment with financial statements. When professionals are forced to rush this process due to time constraints, the possibility of incorrect disclosures, missed adjustments, or incomplete reporting becomes much higher.

Finally, the certification of GSTR-9C demands a high level of professional judgment and responsibility. Since GSTR-9C is a certified reconciliation statement, professionals must be fully satisfied with the accuracy of reported figures before affixing their certification. Certifying such a sensitive document under severe time pressure exposes professionals to compliance risks and potential liabilities, making the process both stressful and risky.

Taken together, this compressed timeline of less than three weeks to complete multiple high-risk compliance activities creates a heavy burden on professionals and taxpayers alike. It not only affects the quality of GST filings but also increases the likelihood of future notices, audits, and litigation, which could be avoided if adequate time were provided through a reasonable extension.

Late Release of Utilities and Frequent Changes in Forms

Another major concern highlighted in the representation is the delayed release of GSTR-9 and GSTR-9C utilities, which were made available only in late October 2025. Annual GST compliance requires advance planning, and the late availability of utilities significantly reduced the effective time available for preparation. The situation became more challenging when major changes were introduced in the forms in November 2025, including modifications in reporting formats and the addition of new compliance requirements. Professionals who had already prepared or partially completed the returns were compelled to revise and redo their work to align with the updated formats. This led to duplication of effort, confusion among taxpayers, and additional time spent on re-verification instead of actual compliance, increasing the overall risk of errors and delays.

Delay in FAQs and Clarifications Added to Confusion

Despite substantial changes being introduced in GSTR-9 and GSTR-9C, FAQs and official clarifications were issued only in November and December 2025, leaving professionals without timely guidance during the initial preparation phase. This delay created ambiguity in interpreting revised disclosures and reporting requirements, resulting in varied approaches being adopted by different professionals. In the absence of clear instructions, many taxpayers followed conservative or assumption-based reporting, increasing the risk of inconsistent and incorrect disclosures. In GST compliance, particularly for annual returns that have long-term legal and audit implications, timely clarity from authorities is crucial. Delayed clarifications not only disrupt preparation but also heighten the chances of future notices and disputes.

Table 8A Update: A Serious ITC Reconciliation Bottleneck

A key technical concern raised relates to Table 8A, which auto-populates ITC details based on GSTR-2A/2B.

This table is essential for:

- ITC matching

- Identifying ineligible credits

- Determining reversals

However, the update to Table 8A was made available only in the first week of December 2025, leaving extremely limited time for final reconciliation.

Late Update of Auto-Populated Table 8A Impacts ITC Reconciliation

One of the most technical yet crucial issues highlighted is the late update of auto-populated Table 8A, which plays a vital role in Input Tax Credit reconciliation.

Table 8A reflects ITC details derived from GSTR-2A/2B and is essential for:

- Matching eligible ITC

- Identifying reversals

- Reporting excess or ineligible credit

This table was updated only in the first week of December 2025, leaving professionals with extremely limited time to complete accurate reconciliations before the due date.

Risks of Rushed Filing Without Extension

If the due date remains unchanged, it may lead to:

- Incorrect or incomplete GST annual returns

- Higher volume of mismatch notices

- Increased litigation and departmental scrutiny

- Defensive reporting by professionals to avoid liability

- Loss of confidence in the compliance framework

From a policy perspective, accuracy and voluntary compliance should be prioritized over hurried deadlines.

Requested Extension Till 28 February 2026

Considering the above challenges, the BJP Professional Cell has requested that the due date for filing GSTR-9 and GSTR-9C be extended to 28 February 2026.

1. This extension would:

- Provide sufficient time after income tax audits

- Allow professionals to adapt to form changes

- Enable proper ITC reconciliation

- Improve overall quality of compliance

- Reduce avoidable disputes and notices

Conclusion

The request made by the BJP Professional Cell is practical, justified, and aligned with the government’s ease-of-doing-business objectives. Rather than seeking leniency, the focus is on ensuring accurate and transparent GST compliance.

An extension of the GSTR-9 and 9C filing deadline would benefit:

- Taxpayers

- Professionals

- The GST administration itself

All eyes are now on the Finance Ministry’s decision, which will determine whether compliance quality or deadline rigidity takes precedence.

Comments

No comments yet. Be the first to comment!